Hello All - Fed Chairman Powell made his intentions clear today. That is, to get inflation back down to 2%. How they gonna do this? Inflict some pain on the economy by raising borrowing costs. Ok, why raise borrowing costs? Because when borrowing costs go up, the number of borrowing transactions goes down. Another word for a borrowing transaction is credit, and credit is money!! That’s right. When someone borrows from the bank, that creates money. When they spend it on something, that creates a purchase transaction and additional GDP or economic production. So by raising rates, they reduce the amount of money in the system and therefore reduce GDP. But why?

Well, The definition of inflation is “too much money chasing too few goods”. So the last couple of years was a perfect storm. There was a lot of govt money out there and also very low rates that spurred credit and therefore increased the money supply. Plus, the number of goods produced was down because the economy was intentionally shut down and then workers held back, so production fell. No wonder there was inflation. There was too much money and too few goods because we couldn’t produce enough. Bang!

But, that was then, and this is now. Now the govt is increasing borrowing costs. This means less borrowing transactions are taking place now which means less money is being created via credit which means lower inflation. Ok, but what about the number of goods? Is production going back up now to create more goods? That would help greatly, but it’s slow. The workforce and global supply is still held back some by covid, boomers retiring, changing work force habits and even the war. However, as money supply comes down this means demand for goods will fall too and that will help. I think it’s already happening, but data is backward looking and we just can’t see it yet. Let’s pray they get this right and we experience a soft landing in the economy. Because in my humble opinion, that’s what this market is waiting for.

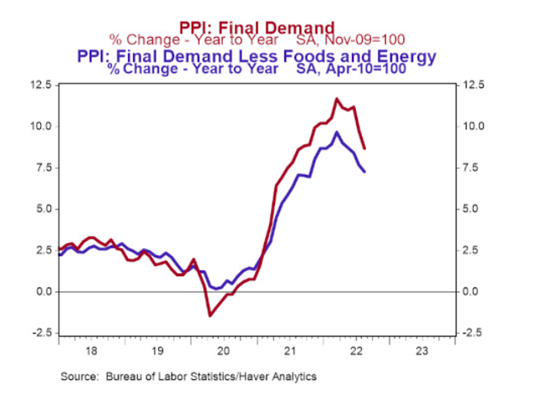

Here’s a better look at year over year inflation trends. Look at the Blue line. PPI is Producer Price Index

Best Regards,

Mike