Hello Everyone and welcome to August. My how time flies doesn’t it? This is a huge reason why I like to just sit tight with my investments……because a year or two goes by so fast it doesn’t pay to be trading in and out. The long-term really isn’t that long-term after all.

Let’s go back in time to the last time the US was experiencing high inflation and the Fed was raising interest rates rapidly. That was back in the early 1980’s. Inflation had gotten as high as 13% and Paul Volker slammed on the breaks by raising interest rates as high as 20% to try and curb inflation. Was he successful? Absolutely! By 1983 inflation had fallen to just 3.2%, the nation was embarking on an extended period of growth, and the stock market was off to the races!

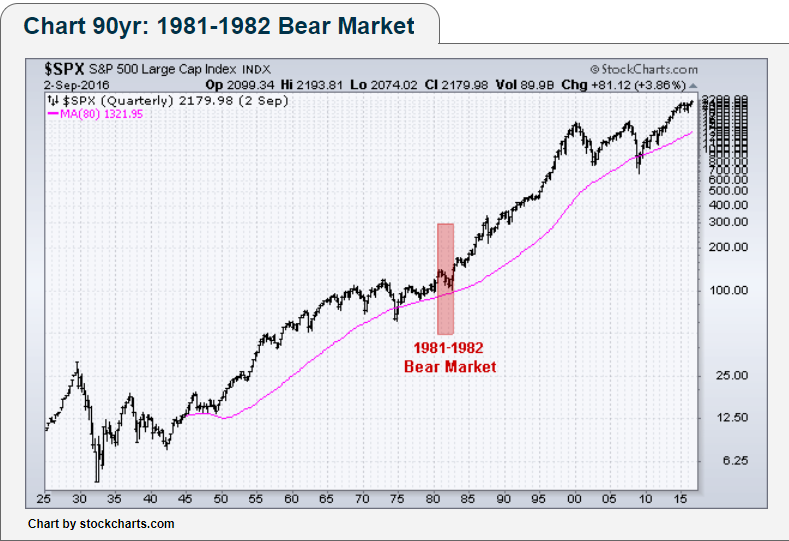

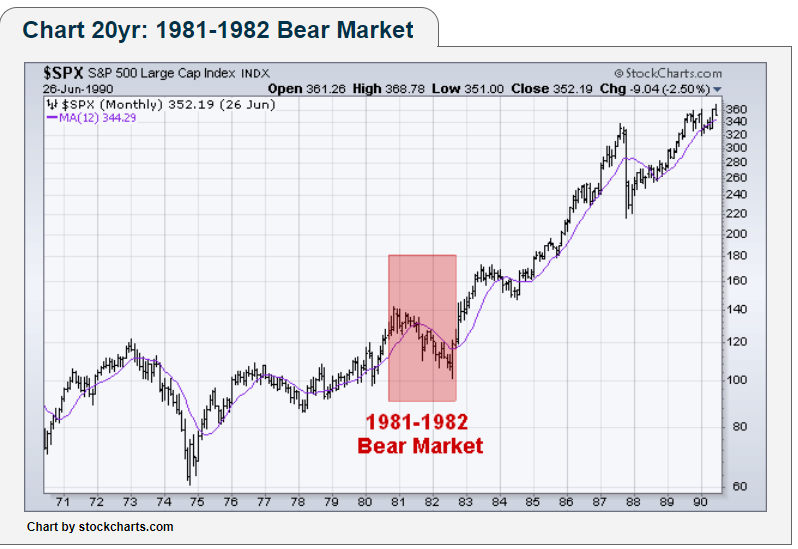

Take a good look at the charts below. They clearly highlight what stocks did during that period of time. In the short-term stocks went down 28% over a period of about 20 months. Then when it finally bottomed in August 1982, it took off and went up some 70% in just 12 months. Longer term, it went up some 10 fold in the next 15 years. Think about that.

I show you this because I feel strongly that we may be setting up for something like this now. The two time periods could not be more similar. An unpopular administration, surging prices, a stock market down more than 20%, a hated war, consumer sentiment in the tank, and a baby boom that lies dead ahead! Is it 1982 or 2022? Either answer would suffice, and now with the luxury of being able to look back, 1982 was indeed one of the best times in history EVER, to be an investor!

My point is this….if you have long-term money to invest, then waiting may cost you, because when the tide finally does turn (if it hasn’t already), it could happen very, very fast. Do we know when it will bottom for sure? Of course not. Nobody does. Nobody can tell you because nobody knows what happens short term. But we do have a good understanding of how prices work over the long-term. They are volatile! This is why we have different strategies for short-term vs long-term money, and this is why we use a bucket approach when developing a sound retirement income plan. We can guide you. Call or email for assistance. We are taking on new clients at this time.

Best Regards,

Mike

Short View

Medium View

Long View